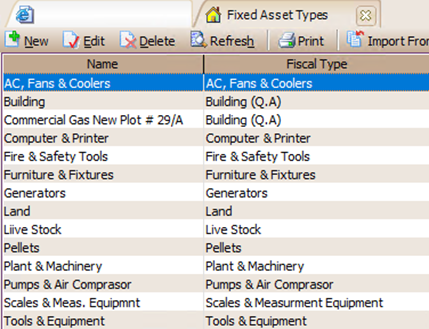

FIXED ASSET TYPE Fixed Asset Type is used to accommodate fixed asset types according to accounting grouping (company policy). For example, we separate the vehicle groups into those aged less than 4 years to 8 years, more than 8 years, or more than 16 years. The grouping of these types of fixed assets depends on company policy. There is no standard standard in the grouping. Fixed Asset List Display (Fixed Asset Type)

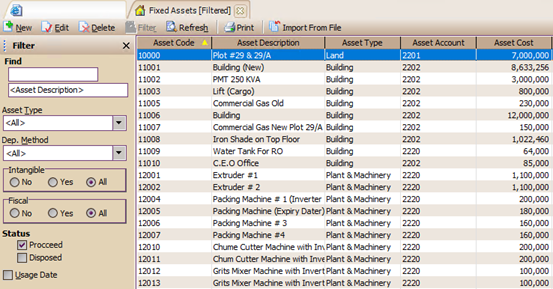

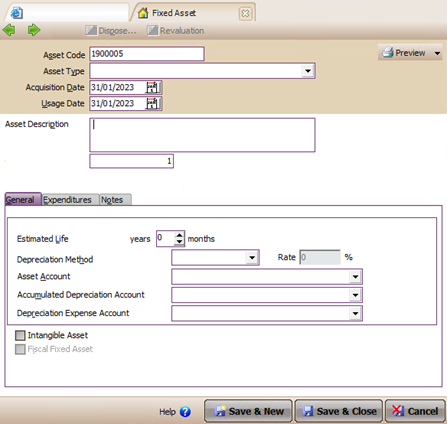

You can make a List of Fixed Asset Types by following the instructions below: 1. New Button : Click this button to create a new type of Fixed Asset. 2. Edit Button : Click this button to edit the List of Fixed Assets that you have created. 3. Delete button : Click this button to delete the Fixed Asset List that you have created. 4. Refresh Button : Click this button to update (update) the display of the List of Fixed Asset Types according to the last input you made. 5. Print Button : Click this button to print a List of Fixed Assets. LIST OF FIXED ASSETS Fixed Asset List is used to display a list of Fixed Assets. List of Fixed Assets that appear by Default are all Fixed Asset that have not been Disposed. One advantage provided by the fixed asset module is that you no longer need to make depreciation journals manually every month. Simply by carrying out Period End activities at the end of each month, LEVERAGE will automatically calculate the depreciation of fixed assets and make journals related to the depreciation of these fixed assets automatically. Fixed Asset List Display (Fixed Assets) The List of Fixed Assets table is a table that displays the List of Fixed Assets that you have, namely all the Fixed Assets that you record through the New Fixed Assets Form. Table of Fixed Assets List can be opened by: 1. Click the main menu List – Fixed Assets (List – Fixed Asset) 2. Then select Fixed Asset List The List of Fixed Assets table displays information consisting of several groups, namely: 1. Menu Button Group. The menu button in the Fixed Asset List Table consists of the following buttons: a. New Button : This button functions to open a New Fixed Asset Form to record new Fixed Assets. b. Edit button: This button functions to change (edit) the highlighted Fixed Asset data. c. Delete button : This button functions to delete (delete) the highlighted Fixed Asset data. d. Find Fixed Asset Column: This column serves to make it easier for you to find the Fixed Assets you want in the Fixed Assets List Table. You can do a quick search by simply typing the name of the Fixed Asset you want in the field <Description> or type the Fixed Asset code you want in the <Asset Code> field. e. Filter Button : This button functions to display the Filter column on the Fixed Asset List side on the Fixed Asset List side. With this filter you can display only the Fixed Assets you want. Filter the List of Fixed Assets, can be done based on: ü Asset Type : Displays Fixed Assets based on the Fixed Asset type filter. This filter displays a choice of types of Fixed Assets according to the List of Fixed Asset Types that you have created. ü Dept. Method : Filter the list of Fixed Assets based on the type of Fixed Assets depreciation method. Filter by Dep. The method consists of 5 options: 1. All : Displays all Fixed Assets with all types of depreciation methods (Fixed Assets depreciation methods are not filtered). 2. Non Depreciable : Displays only the List of Fixed Assets that are not depreciated. 3. Straight Line Method : Displays only a List of Fixed Assets depreciated using the Straight Line Method. 4. Sum Of Year Digit Method : Displays only a List of Fixed Assets depreciated using the Sum Of Year Digit Method. 5. Double Declining Method: Displays only a List of Fixed Assets which are depreciated using the Double Declining Method. ü Intangible: Filter List of Intangible Fixed Assets. There are 3 options: 1. No : Displays only the List of Tangible Fixed Assets. 2. Yes : Displays only the List of Intangible Fixed Assets. 3. All : Displays all types of Fixed Assets in the List of Fixed Assets, both Tangible Fixed Assets and Intangible Fixed Assets. ü Fiscal : Filter List of Tax Fixed Assets. 1. No : Displays only the List of Fixed Assets where the Fiscal Fixed Assets are unchecked. 2. Yes : Displays only the List of Fixed Assets whose Fiscal Fixed Assets are checked. 3. All : Displays all Fixed Assets in the Fixed Assets List, whether Fiscal Fixed Assets are checked or not. ü Status : Filter the list of Fixed Assets based on the status of Fixed Assets. 1. Proceeded : Displays only the List of Fixed Assets which are still active and have not been disposed of. 2. Disposed : Displays only the List of Fixed Assets that have been disposed of. ü Usage Date : Filter List of Fixed Assets based on the date of use of Fixed Assets. ü Acquisition Date : Filter List of Fixed Assets based on the date of purchase of Fixed Assets. f. Refresh Button: This button functions to update the appearance of the Fixed Asset List according to the last input you made. 2. Columns in Detail Table of Fixed Assets List. Details Table of Fixed Assets List displays the columns that present the information contained in the Fixed Assets Form. These columns consist of: a. Asset Code : This column displays the Fixed Asset Code information that you have. b. Asset Description : This column displays the name of the Fixed Asset that you have. c. Asset Type : This column displays information on the type of Fixed Asset that you have. d. Asset Account : This column displays account information that records the acquisition of Fixed Assets that you own. e. Asset Cost : This column displays information on the acquisition value of the Fixed Assets that you have. f. Usage Date : This column displays information on the usage date of your Fixed Assets. g. Purchase Date : This column displays information on the purchase date of your Fixed Assets. h. Estimated Life : This column displays information on the useful life (life) of the Fixed Assets that you own. i. dept. Rate : This column displays the percentage information used as the basis for calculating the depreciation of your Fixed Assets. j. dept. Method : This column displays the depreciation method used in calculating the depreciation of your Fixed Assets. k. Department : This column displays the Department number information related to the Fixed Assets that you have. l. Intangible : This column displays information on the type of Fixed Assets you have. What is the type of tangible fixed assets or intangible types of fixed assets. m. Fiscal : This column displays information on the fiscal status of your fixed assets. 3. Right Mouse Click on Fixed Asset List. Some of the activities you can do with Right Mouse clicks include: a. New : Right Mouse Click then select New has the same function as if you clicked the NEW menu button on the Fixed Assets List, which functions to open a new Fixed Assets Form to record your new Fixed Assets data. b. Edit : Right Mouse Click then select Edit has the same function as if you clicked the EDIT menu button on the Fixed Asset List, which functions to change (edit) the highlighted Fixed Asset data. c. Delete : Click the Right Mouse then select Delete. It has the same function as if you clicked the DELETE menu button on the Fixed Assets List, which functions to change (edit) the highlighted Fixed Assets data. d. Filter Ctrl+F : Right Mouse Click then select Filter has the same function as if you click the FILTER menu button on the Fixed Asset List, which functions to display the Filter column on the left side of the Fixed Asset List. e. Sort by: Click the Right Mouse then select Sort by, serves to sort the display of the List of Fixed Assets according to the column headings contained in the List. f. Refresh : Right Mouse Click then select Refresh (F5) has the same function as if you click the Refresh menu button on the Fixed Asset List, which functions to update/update the display of the Order Financing List is in accordance with the last input that you did. g. Delete Last Edit : Right Mouse Click Delete Last Edit will be active if the highlighted Fixed Assets are Fixed Assets that have been changed or edited. Right Mouse Click Delete Last Edit functions to delete the last edit you have ever made to the fixed asset. FORM NEW FIXED ASSET The New Fixed Asset Form is a form that you can use to record the Fixed Assets that you own. The New Fixed Assets form can be opened by: 1. Click the main menu Activities – New Fixed Assets 2. Or it can be opened from the explorer menu by clicking the Fixed Assets button on the explorer menu and then selecting New Fixed Assets. View of New Fixed Assets Form You can fill out the New Fixed Assets Form by following the instructions below: 1. Previous Button : With this button you can view the appearance of the Fixed Assets Form that you have previously created. 2. Next Button : With this button you can see the display of the next (next) Fixed Assets Form. 3. Preview button: This button functions to preview the printed display of the Fixed Asset Form on the monitor screen. 4. Printer Button: This button functions to print the appearance of the Fixed Assets Form. 5. Dispose button: This button functions to display the Fixed Asset Disposal form which functions to record Fixed Asset Disposal activities. 6. Revaluation button: This button functions to display the Fixed Asset Revaluation form which functions to record Fixed Asset revaluation activities. 7. Asset Code column: In this column you can type the Fixed Asset code that you input. 8. Asset Type Column: In this column you can type the type of Fixed Asset that you input. 9. Asset Description column: In this column you can type the name of the Fixed Asset that you input. 10. Acquisition Date Column: In this column you can type the purchase date (acquisition date) of the Fixed Assets that you input. 11.Usage Date column: In this column you can type the date the Fixed Assets you input will start to be used. 12.Quantity column: In the column you can type the total quantity of the Fixed Assets that you input. 13.Department Column: In this column you can choose the name of the Department that relates to the Fixed Assets that you input. 14. General Table Details: In this detail table you can fill in general information about the Fixed Assets that you input: a. Estimated Life: In this column you can fill in the useful life (economic life) of the Fixed Assets that you input. Filling in the useful life of Fixed Assets may not be < than 1 year but must be ≥ 1 year. b. Depreciation Method : In this column you can select the Fixed Asset depreciation method that you will use to calculate the Fixed Asset depreciation that you input. c. Asset Account: In this column you can choose a Fixed Asset type Account to record the acquisition of the Fixed Assets that you input. d. Accumulated Depreciation Account : In this column you can select the account that will be used to record the Accumulated Depreciation of Fixed Assets that you input. e. Depreciation Expense Account: In this column you can select an expense account that will be used to record the Fixed Asset Depreciation Expense that you input. f. Intangible Assets: You can check the Intangible Assets check box if the Fixed Assets you input are intangible types of Fixed Assets. Examples of types of intangible Fixed Assets: Copyright, Royalties, Goodwill. When the Intangible Asset check box is activated, LEVERAGE will automatically remove the Accumulated Depreciation Account column. g. Fiscal Fixed Assets : You can check this Fiscal Fixed Assets check box if you also want to calculate the depreciation of the Fixed Assets that you input based on Fiscal provisions. 15.Expenditure Table Details: In this detail table you can fill in information about the acquisition value of the Fixed Assets that you input: a. Account No : In this column you can type in the Account number which records your economic expenses (sacrifice) in connection with the acquisition of the Fixed Assets that you input. If you do not memorize the account number, then you can directly select it from the Account List by double clicking on the column or by clicking the Ellipsis [...] button or you can also do it by using the Ctrl+Enter key combination on your keyboard. If the Fixed Assets you input are balances from the period before using LEVERAGE, then you can fill in this column for Account No with the Opening Balance Equity Account number, if the Fixed Assets you input were obtained in cash you can directly fill in this column with the Cash/Bank Account number that you used to obtain the Fixed Assets, but if the Fixed Assets that you entered were obtained on credit then you cannot directly fill in this account number with a debt account but must use an Intermediary Account called a Fixed Asset Transaction (Other Current Asset account type). b. Date : This column will automatically display the acquisition date of the Fixed Assets that you input (same as the date in the Acquisition Date column). c. Description : This column will automatically display a description or account name from the account number you choose. d. Amount : In this column you can type the acquisition value of the Fixed Assets that you input (the intended acquisition value is the acquisition value of the Fixed Assets before depreciation). e. Assets Cost : This column automatically displays the total Amount in the Expenditure table. f. Disposed Asset : This column automatically displays the value of Disposal of Fixed Assets. g. Depreciation Amount : This column automatically displays the accumulated depreciation value of the Fixed Assets that you input (Total accumulated depreciation value is automatically calculated from Period End Activities). h. Accounting Book Value : This column automatically displays the book value of the Fixed Assets that you input (LEVERAGE automatically calculates the book value of the Fixed Assets that you input. i. Salvage Value : You can fill in this column manually according to the residual value of the Fixed Assets that you input. This column can be filled with the condition that the depreciation method you use to calculate depreciation for Fixed Assets that you input is the Straight Line method and the Sum Year Digit Method. If you fill in this column, LEVERAGE will automatically calculate the amount of depreciation of Fixed Assets with the formula: (Assets Amount – Salvage Value) x percentage of depreciation. 16.Detail Notes: In this detailed table you can fill in information about the Fixed Assets that you input. 17.Save & New button: This button functions to save the displayed Fixed Asset Form and at the same time open a new Fixed Asset Form view. 18.Save & Close button: This button functions to save the displayed Fixed Asset Form and at the same time close the Fixed Asset Form. |