√ Retained Earning Account: choice of account used to accommodate the difference in balance. Profit and Loss of previous years. If there is already a profit/loss transaction, this account cannot be changed.

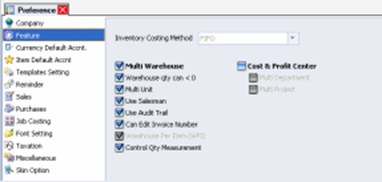

2. Feature: Preferences about features that can be selected from the available features.

You can set feature preferences based on the following instructions:

a. Choice (option) of some of the facilities provided by LEVERAGE:

· Multi Warehouse : Check this check box to activate the Multi Warehouse feature, with this feature you can use more than one warehouse

· Warehouse qty can < 0 : If you check this check box, then you can carry out activities of selling goods or activities of releasing goods from the Warehouse even though the quantity in the Warehouse is already 0. With this feature the quantity of goods in the warehouse can be less than Zero

· Multi Unit : Check this check box to activate the Multi Unit feature. With this feature you can use more than one unit formula.

· Use Salesman: Check this check box to activate the Salesman feature. With this feature you can record the salesman's name in the sales form

· Use Audit Trail : Check this check box to activate the Audit Trail feature. With this feature, LEVERAGE will record all activities carried out in the LEVERAGE database, so you can control every activity that occurs in your LEVERAGE database.

· Cost & Profit Center : Check this check box to activate the Cost & Profit Center feature.

o Multi Department: using more than one Department.

o Multi Project: using more than one Project.

· Can Edit Invoice Number: Check this check box to activate the Can Edit Invoice Number feature. With this feature you can change or edit the Invoice number that you have created.

· Warehouse Per Item: Check this check box to activate the Warehouse Per Item feature. With this feature you can choose a detailed warehouse for each item that you record in buying and selling activities.

· Control Qty Measurement : Check this check box to activate the Control Qty Measurement feature. The Control Quantity Measurement feature functions to calculate the control quantity in the Warehouse. What is meant by "quantity control" is the quantity calculated according to the unit in the Warehouse which is usually different from the unit according to accounting. Example: For example Cloth, unit the accounting is Meters but usually in the Warehouse it is calculated in rolls or bales.

How to Use the Control Qty Measurement Feature:

1. Activate this feature by ticking the Control Qty Measurement check box.

2. When inputting the transaction form, the Qty Control column will appear in the item details. Fill in the Control Qty column with the quantity issued or received by the Warehouse for the accounting quantity that you filled in the Quantity column on the form.

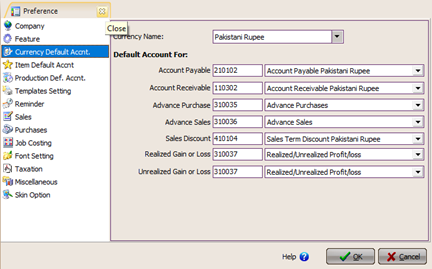

3. Currency Default Account : Default Account Currency Settings.

You can set the default account currency according to the instructions below:

· Account Payable: default accounts payable that functions to record debts on Purchase Invoice, Purchase Return, Purchase Payment, and Period End forms.

· Account Receivable: default accounts receivable that functions to record receivables on the Sales Invoice, Sales Return, Sales Receipt and Period End forms

· Advance Purchase: default purchase advance payment account which functions to record advance payment activities to Vendors (Suppliers). The account that you can select in this column is a purchase advance account with the type of receivable (account receivable).

· Advance Sales: the default sales advance account that functions to record the activity of receiving sales advances from customers (customers). The account that you can select in this column is a sales advance account with a payable type.

· Sales Discount: the default sales discount account that functions to record sales invoice discounts that you give to your customers. The account that you can select in this column is an account with revenue type.

· Realized Gain or Loss: records the exchange rate difference when paying debts or receiving settlement of receivables in foreign currency, where there is a difference in the exchange rate when payment is made at the time the debt/receivable is incurred.

· Unrealized Gain or Loss: records the difference between the initial exchange rate (transaction) and the exchange rate at the end of the period (Period End).

Accounts that appear in the Account Payable & Account Receivable options in each Default Currency are accounts that use the same Currency as the Default Account Currency on it.

The Default Account option for Account Payable & Account Receivable must be different for each currency, but for the Sales Discount, Realized Gain or Loss and Unrealized Gain or Loss options, you can make one account or you can also separate them to find out more details about changes in each account per currency.

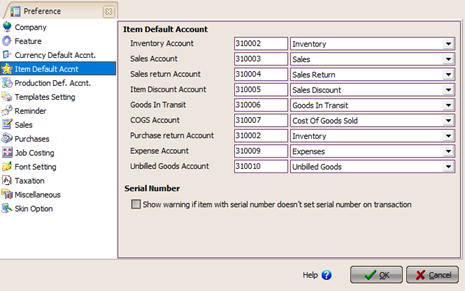

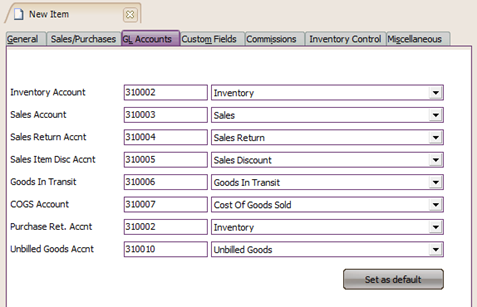

4. Item Default Account : Preference for item default account

This preference functions to make a standard GL Account every time you create a New Item (New Items). If the new item you create has a GL account that is different from the default account that you have entered in this preference, then you can adjust the new item's GL account directly on the GL account tab in the new item entry form.

You can set item default account preferences (default account items) based on the instructions below:

· Inventory Account: for Inventory Parts type, will make a journal for this account when buying, selling and sending goods. What appears in the account options are accounts with inventory type only.

· Sales Account: for all types of items that hold the amount of sales for that item (only for the Sales Invoice form).

· Sales Return Account: for all item types except for the Service type which holds the sales return amount for that item (in the Sales Return form).

· Good In Transit: Default Account that functions to record goods delivery transactions to customers recorded on the Vendor form. Fill in this column with an Inventory type account.

· Item Discount Account: to accommodate discounted items in each Sales Invoice & Sales Return transaction.

· COGS Account : only for Inventory Part type, to accommodate the Cost of Goods Sold account for the item when a Delivery Order/Sales Invoice/Credit Memo occurs.

· Purchase Return Acc. : only for Inventory Part type, namely when a purchase return occurs.

· Expense Account : only for Non Inventory Part type, that is when a Purchase (Purchase Invoice) and Received Item occur.

· Unbilled Goods Acc. : only for Inventory Part type items, namely when an Item Receive occurs and has not been used as a bill (Bill Receive). The default account type is Other Current Liability.

5. Template Setting

Preference for specifying the default amount of detail in the Standard Tax Invoice template. This template setting determines the number of sheets to be printed for a Standard Tax Invoice, whether to print only one sheet or three consecutive sheets with a page number on the top right.

6. Reminder

Preference to determine how many days LEVERAGE reminds you of your debts/receivables before maturity and items that are equal to or below the minimum reorder stock.

Show Reminder:

· Every Time LEVERAGE start up: if enabled it will always appear the first time when opening an LEVERAGE database.

What to Show:

v Item Reorder: displays items that are the same or over qty limited and minus.

v Receivable Due: displays accounts receivable several days before maturity.

v Payable Due: displays debts many days before maturity.

v Payable Discount Due: displays purchase discounts that may be available for several days from the last date of the discount period.

v Receivable Discount Due: displays sales discounts that may be given a number of days from the last date of the discount period.

v Receivable Receipt: displays the customer receipt number (Sales Receipt) several days before the check's due date.

v Payable Payment: displays the Purchase Payment number (vendor) several days before the check's due date.

v Recurring : displays recurring forms days before the recurring due date.

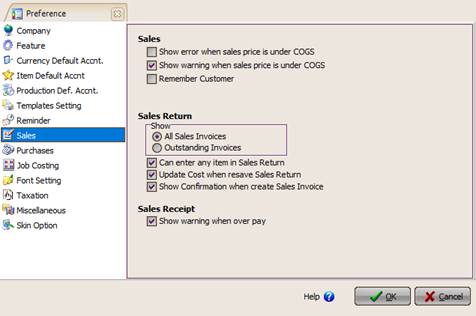

7. Preference - Sales

Preference settings related to sales activities.

You can set sales activity preferences based on the following instructions:

Sales Invoice

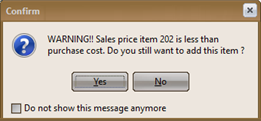

a. Show warning when sales price is under COGS: Displays a warning when you record sales of goods on the Sales Invoice form with the selling price of goods below the cost of goods sold.

Sales Return

Show:

• All Sales Invoices: Can carry out Sales Return activities on all Sales Invoices, both paid and unpaid.

• Outstanding Invoice: Can only carry out Sales Return activities on Sales Invoices that have not been paid off.

b. Can enter any item in Sales Return : Can select any item on the Sales Return form, except for items with suspended status.

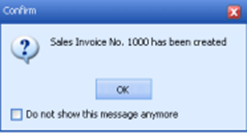

c. Show Confirmation when create Sales Invoice: Displays a confirmation message when LEVERAGE creates a Sales Invoice when you do a Sales Return activity for items that don't have a Sales Invoice (Sales Invoices for returned items are not recorded in LEVERAGE).

Sales Receipt

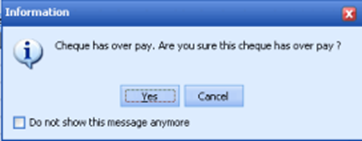

d. Show warning when overpay : Displays a confirmation message when you record customer receipts with excess amounts (Overpay).

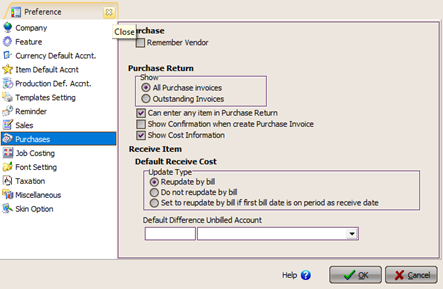

8. Preference – Purchase

Preference Purchase is a preference related to the arrangement of purchasing activities.

You can set Purchase preferences based on the following instructions:

Purchase Return

Show

• All Purchase Invoices: Can carry out Purchase Return activities on all Purchase Invoices, both paid and unpaid.

• Outstanding Invoice: Can only carry out Purchase Return activities on Purchase Invoices that have not been paid off.

Ø Can enter any item in Purchase Return : Can select any item on the Purchase Return form, except for items with suspended status.

Ø Show Confirmation when create Purchase Invoice : Displays a confirmation message when LEVERAGE creates a Purchase Invoice when you carry out a Purchase Return activity for items that do not have a Purchase Invoice (the Purchase Invoice of the items you returned is not recorded in LEVERAGE).

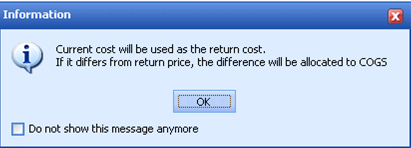

Ø Show Cost Information : Displays a confirmation message when you return goods, where the return value that you record on the Purchase Invoice form is different from the cost value of the item, where the difference between the return value and the cost value of the item will be automatically allocated to the Cost of Goods Sold account .

Preference - Receive Item – Default Receive Cost

This feature is related to setting up the recognition of the cost of goods recorded on the Receive Item/Goods Receipt form.

Receipt of goods from vendors without vendor invoices will usually be recorded using the Receive Item form. If the Receive Item form is made based on a Purchase Order, the value of the goods received will be recorded in accordance with the value of the goods recorded on the Purchase Order form and if the Receive Item form is made without a Purchase Order preceded, the value of the goods received will be recorded with a value of 0.

Problems arise when a vendor's invoice for receipt of the goods is received, where the invoice contains the purchase value of the goods you received and there are times when the value of the invoice for goods is not the same as the value of the goods ordered, causing a change in the cost of entering goods.

If the recording of receipt of goods and receipt of bills for the purchase of goods is carried out in the same period, of course this change in cost will not be a problem, but if the period for receiving goods and the period for receiving invoices is not the same, a problem will arise, namely recording invoices in the current period will affect the value inventory that was recorded in the previous period. To overcome this problem, LEVERAGE provides a Default Receive Cost feature which consists of 3 Update Types, namely:

v Reupdate by bill: the value of the cost of goods received on the Receive Item form recorded in the past period will automatically update (updated) according to the value of the goods on the invoice (Purchase Invoice) when the Purchase Invoice for receipt of the goods is recorded.

v Do not reupdate by bill: the value of the cost of goods received on the Receive Item form recorded in the past period will not be updated according to the value of the goods on the invoice (Purchase Invoice) when the Purchase Invoice for receipt of the goods is recorded. So the value of the goods will not change, where the difference between the value of the goods received and the value of the goods on the bill will be recorded in the "Default Difference Unbilled Account". Recommended account as default difference Unbilled Account is an account with the Cost Of Good Sold type.

v Default Difference Unbilled Account is a default account that functions to record the difference in the value of the cost of goods received (Receive Item) with the value of the cost of goods on the bill (Purchase Invoice).

· Set to reupdate by bill if first bill date is on period as receivable date : If the Receive Item and Purchase Invoice forms are recorded in the same period, LEVERAGE will automatically update/update the inventory value recorded on the receive item form according to the inventory value recorded on the Purchase Invoice form, where if you edit the date of the Purchase Invoice to a date in a different period from the period of receiving the item, the updated inventory value will no longer change but will still follow the value of the Purchase Invoice. Conversely, if the recording of Receive Item and Purchase Invoice is made in different periods, LEVERAGE will not update/update the inventory value recorded on the Receive Item form where the difference between the inventory value at the time of receipt and the time of the bill will be recorded in the default difference Unbilled Account. If there is an edit to the transaction period either on the Receive Item form or on the Purchase Invoice form, the inventory value will not change.

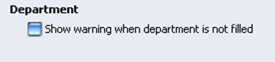

9. Preference – Cost & Profit Center

a. Department

Through this preference you can set LEVERAGE to display a confirm message every time you do not fill in the Department field on the invoice.

b. Project

The default project account setting is required so that LEVERAGE can record/journalize project activities to the right account so that LEVERAGE can present proper and LEVERAGE financial information. You can guide the LEVERAGE user (customer) to do it

Setting the default project account by following these instructions:

1. Setting the default project account can be done via the Preferences form, so when you ask a customer to click on the main menu Setup – Preferences – Cost & Profit Center – Multi Project.

2. Setting the default account for project cost by following these instructions:

DEFAULT ACCOUNT FOR PROJECT COST

Default Account For Project Cost is the default account that functions to record labor and overhead used in project activities.

LEVERAGE will automatically record (journalize) the Labor and Overhead used in project work when you create the Material In Used Form [Labor &Overhead Tab].

This default account is almost the same as the default account item. The Default Account for Project Cost that you fill in in this Preference form will be used as the default Account every time you create a new Project Cost in the Project Cost List. It's the same with Item Default Account, you can adjust the Default Account for Project Cost with the new project cost that you create.

To make it easier to fill in the Default Account for Project Cost, the following is an explanation:

ü Expense Account: This Default Account serves to record costs for the use of labor and overhead in project activities. So in this field you can choose an account with Expense Type.

ü Prepaid Account: This Default Account serves to record debts / obligations arising from the use of labor and overhead in project activities. So in this field you can select an account with Type Other Current Liabilities

3. Setting the default account for project cost by following these instructions:

ü You can fill in the Project In Process field with an Account of the Other Current Asset type. The default Project In Process account serves to record project work in progress, where the value of this account is the accumulation of the material values used in the project plus the value of labor and overhead used in the project. LEVERAGE will automatically debit this account when you create the Material In Used Form.

ü You can fill in the Advanced Revenue field with other current liabilities type accounts. The Advanced Revenue default account serves to record project DP billing to customers. This account is automatically credited when you create a Sales Invoice Form to record project DP bills to customers.

ü You can fill in the Revenue Field with a revenue type Account. The default Revenue account serves to record Project billing to Customers. This account is automatically credited when you create a Sales Invoice Form to record Project billing to Customers.

ü You can fill in the Cost of Good Sold field with a cost of good sold account type. The default Cost Of Good Sold account serves to record the cost of the Project. This account is automatically debited when you create a Sales Invoice Form to record Project billing to Customers.

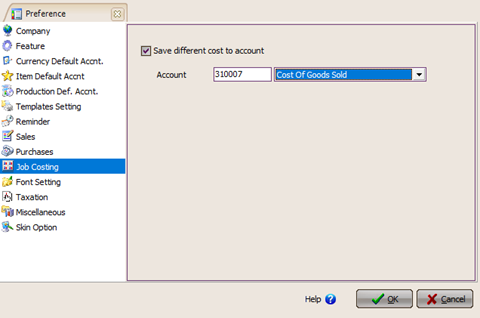

10. Preference – Job Costing

The Job Costing preference setting functions to set the default account that will be used to accommodate differences arising from changes in the value of raw materials for finished job costing activities. So if there is a change in the cost of the raw materials used in Job Costing activities where the Job Costing activities have already been completed, this account serves to accommodate the difference due to changes in the cost of these raw materials so that Cost Finished Good of the Job Costing activities will not change.

The recommended account as the default different cost is an account with the Cost Of Good Sold type.

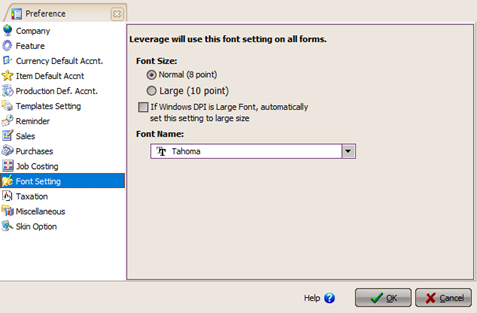

11. Preference – Font

Preference - Font Setting is a preference related to the display font settings in the LEVERAGE Accounting Software program. Through this preference you can determine the font name and font size that you will use as default in the LEVERAGE Accounting Software program.

12. Preference – Taxation

Preference Taxation is a preference related to VAT recording settings, numbering on Standard Tax Invoices and Default account settings for Income Tax.

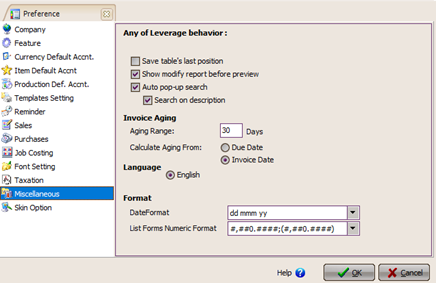

13. Preference – Miscellaneous

Preferences – Miscellaneous are preferences related to setting the behavior of the LEVERAGE program, setting the language to be used, setting the number format, setting the date format and setting the age of the invoice (Invoice Aging).

LEVERAGE behavior settings include:

LEVERAGE behavior settings include:

ü Auto refresh data on tables module : LEVERAGE automatically updates the table view every time you perform activities on the LEVERAGE database.

ü Save table's last position: When you change the form of a table display in LEVERAGE, for example shrinking the Forms List table or enlarging the Forms List table, LEVERAGE will automatically save the changes in the table's position or shape.

ü Show modify report before preview : When you open a report, LEVERAGE will automatically display the Modify Report form before displaying the report you want to open. So you can modify the report before it is displayed.

14. Preference – Skin Option

Preference Skin Option is a preference related to setting the skin appearance of the LEVERAGE Accounting Software program.