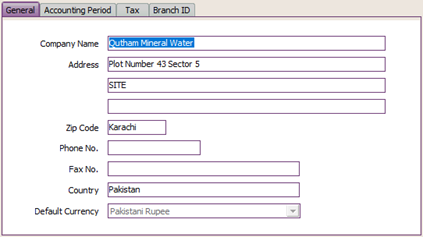

Information about company data such as name, address, fiscal year, start date (start date of the LEVERAGE database), currency used as the default report and warning period when entering transactions at LEVERAGE can be entered via the main menu Preparation – Company Information (Setup – Company Info) ). The Company Information filling form consists of 3 tabs, namely: 1. General tab. On this tab you can fill in general information about your company which includes: a. Company Name : Full name of the company. This name will be displayed as a header when you print invoices and reports. Typing the full name of the company can be done max. 60 characters. b. Address 1 : Company address (Street Name and No) c. Address 2 : Company address (Name of District, City and Regency). d. Address 3 : Name of Province e. Zip Code : Zip Code f. Phone No : Company Phone Number g. Fax No : Company Fax Number h. Country : Name of the country where the company is domiciled. i. Default Currency : The base currency used by a company when making transactions using other currencies. The following is an example of an image filling the General Tab:

2. Tab Accounting Period. On this tab, you can fill in information relating to your company's Accounting period, which includes: a. Start Date : Date of database initial balance or date of bookkeeping using LEVERAGE.Example: You will start using LEVERAGE to record your company's financial transactions in 2009 with the condition that you have balance data from your old bookkeeping (2008 fiscal year). For this condition you can input Start Date 31-12-2008. If your company is newly established where you don't have balance data from the old bookkeeping, then you can input the Start Date 01-01-2009. b. Fiscal Year: In this column, enter the company's financial year. Usually this column is filled with the year you input in the Start Date column. Example: if the start date is 31-12-2008 then you can fill in the fiscal year column with 2008. You can fill in the fiscal year by typing only two digit numbers, so for 2008, just type 08. c. Default Period : Automatically filled in according to your computer's system date. d. Warn If Before ....... or ....... After Default Period : Raise a warning if the transaction date you input is .... month/year before the default period or .... month/year after Default Period, but you can still continue inputting transactions without having to change the date. Example: The Default Period shows the period October 2008. You enter the Warn If Before 2 Months or 1 Month After Default Period. Meaning : LEVERAGE will display a warning when you input or edit a transaction with a date before September 2008 or if you input or edit a transaction with a date after October 2008. e. Error If Before ....... or ......... After Default Period : Generates an error if the transaction date you input is ..... month/year before the Default Period or ..... month /year after the Default Period. You will not be able to continue inputting transactions with a restricted date unless you change the allowed date. Example: The Default Period shows the period October 2008. You fill in the Error If Before 2 Months or 1 Month After Default Period. Meaning : LEVERAGE will display ERROR when you input or edit transactions with dates before September 2008 or if you input or edit transactions with dates after October 2008. 3. Tax tab. On this tab you can fill in tax data information which includes: a. Company Name : The full name of the company that will be displayed when you print a Standard Tax Invoice. b. Address: The company address that will be displayed when you print a Standard Tax Invoice. c. Serial Number Form: Standard Tax Invoice serial number which will be displayed in the first column of the Standard Tax Invoice serial number. d. Tax Registration Number : National Tax Number (NTN). e. Sales Tax Reg. Number : Sales Tax Number. f. Tax Registration Date: Company Confirmation Date as a Taxable Entrepreneur. g. Branch Code : Branch Code h. Type: What type of company is engaged in. 4. Tab Branch ID. Filling in the branch code on this tab is related to Extract Import Transaction activity. |